Trade deals spark fresh record highs in stocks, USD off

- US-EU close in on 15% tariff deal, according to the FT

- Bessent says “no rush” to choose successor to Fed’s Powell

- GOOG and TSLA earnings mildly disappoint with both stocks off after hours

- ECB set to end cut streak amid US trade tensions, stronger EUR

FX: USD was quiet for most of the day until the story about an EU-US trade deal. The greenback was generally sold versus the antipodeans, and less so EUR and JPY. In fact, it was only the euro underperformance that held up the Dollar Index, which has roughly a 56% weighting of the single currency in that basket. Progress on trade is welcome but only a handful of deals have been concluded and the (apparent) August 1 deadline is fast approaching with no concrete agreement still with the US’ two biggest trading partners – the EU and China. The media report on the former has not yet been backed by the White House. That reported 15% tariffs and waivers on certain products. The recent cycle long is at 96.37 with a long-term upward trendline from lows in 2011, just above here.

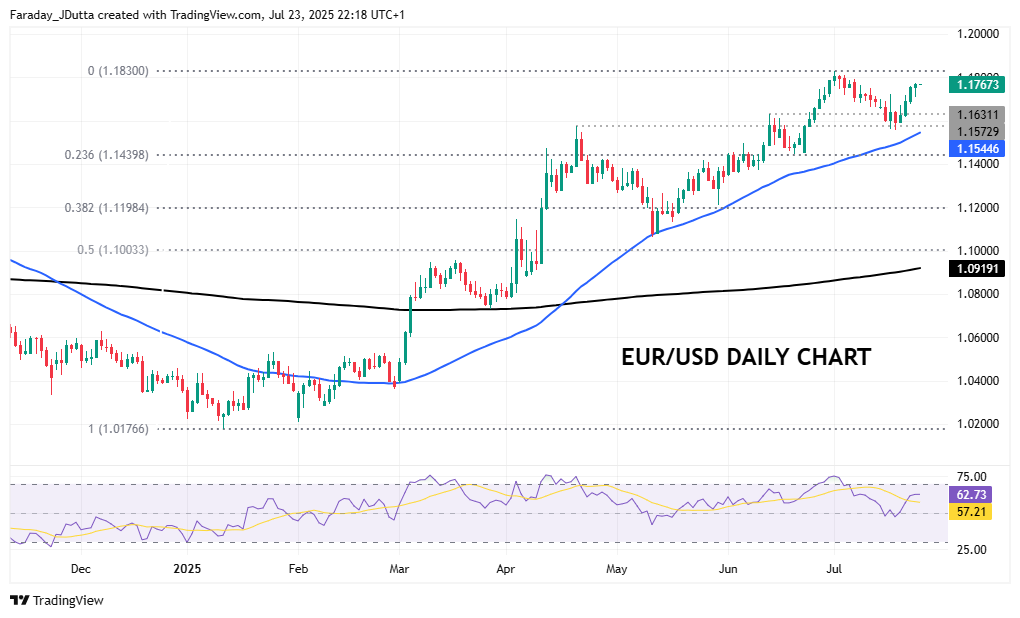

EUR looked to be pausing its recent rebound after three back-to-back days of buying until the possible trade deal saw the major go green. Sentiment was front and centre with positive Japan trade news highlighting the lack of progress between the EU and US through the early sessions. Short-term spreads have been climbing this week, helping the euro. Focus turns to today’s ECB meeting – see below for more.

GBP traded higher for a third straight day as cable climbed above resistance/support at the 50-day SMA at 1.3520. There has been little domestic news, but BoE rate cut expectations have been slightly pared back this week which have helped sterling. PMI data today should see a modest uptick in both services and manufacturing.

JPY marginally strengthened as the major printed a doji, denoting indecision. The trade deal was obviously good news, and for the BoJ too and potential rate hikes going forward as uncertainty eases. But the domestic political uncertainty offsets this with the resignation of Ishiba potentially happening soon.

AUD and NZD outperformedin the wake of the US-Japan trade deal and hopes for other countries in the region following a similar process and agreement in the region.The aussie made a fresh cycle high above 0.66 with bullish momentum solid. CAD underperformed as focus switched to little news and progress on any Canadian trade agreement.

US stocks: The S&P 500 printed up 0.78% at 6,359, another fresh record closing high. The Nasdaq settled higher, by 0.43% at 23,162. The Dow Jones finished up at 45,010, adding 1.53%. The record high is 45,054. Health, Industrial and Energy led the gainers – notable defensive stocks, while only Utilities and Consumer Staples were in the red. Tesla reported after the closing bell and missed on Q2 earnings and revenue, though it said its “more affordable” model is planned for 2025. The EV-maker also said its robotaxi was still scheduled for mass production starting in 2026. The stock was off 1% after hours. (The conference call was about to start as we wrote this.) Alphabet smashed Q2 earnings estimates, with revenue surging 14% and profits at all-time highs. Despite jumps in ads and cloud sales, shares slipped initally before picking after hours as fresh spending plans took centre stage. Texas Instruments gave a soft outlook fuelling concerns that recent tariff-driven demand may not last.

Asian stocks: Futures are in the green. APAC equities were mostly higher after Japan, Philippines and Indonesia trade deals were announced. The ASX200 saw strength in miners, energy and resources offset defensive weakness. The Nikkei 225 surged above 41,000 after the trade agreement. Automakers jumped double -digits and boosted the index on news of lower tariffs of 15% rather than the initial 25%. This came amid reports that PM Ishiba was to resign soon, though he denied this later. The Shanghai Comp and Hang Seng were in the green with a possible Trump-Xi meeting touted soon. Treasury Secretary Bessent also said there could be an extension to the August 12 deadline, and he will attend talks with China early next week.

Gold gave back some recent gains as haven demand eased back on improved trade deal news. The upside break in recent days poked above a bullish triangle pattern that has developed since May, but eventually closed below it.

Day Ahead – ECB Meeting

It’s a summer central bank meeting and the ECB is expected to sit on its hands later today. That means it will keep the deposit rate at 2%, right in the middle of its neutral range of 1.75% – 2.25%. The Governing Council are likely to stress their continued data dependence and meeting-by-meeting approach with no change in guidance. The lack of urgency shown at the June meeting, with no big surprises in inflation or activity data and renewed tariff uncertainty should provide perfect cover for a quieter meeting, while potentially planning for another rate cut in September.

The biggest current source of uncertainty stems from the ongoing trade frictions between the EU and US. Both sides are attempting to agree a deal ahead of the August 1st deadline, which would see the US impose a 30% tariff on EU goods and the EU likely respond with its own countermeasures. The successful outcome of the tariff negotiations will be key for monetary policy going forward, as tariffs higher than 10% on the EU would deviate from the ECB’s baseline assumptions. Such fears are weighing on the growth outlook and, allied with the appreciation in the euro this year, have stoked concerns that the ECB could undershoot its 2% inflation target.