US Inflation Cools, But Is It Enough For A Fed Pivot?

U.S. inflation continues to ease, but is it enough to tip the scales for the Fed? The April Core PCE index, widely regarded as the Fed’s preferred inflation gauge, slowed to 2.5% YoY, marking the lowest annual reading in over two years. While this reinforces the disinflation trend and strengthens the case for Fed rate cuts in the second half of the year, policymakers remain cautious.

Fed Chair Jerome Powell recently reiterated that the central bank is in no rush to cut rates. In his testimony before the House Financial Services Committee, Powell said the Fed is “well positioned to wait” and assess how the economy and inflation respond to recent developments, particularly tariffs, before making any policy changes. That stance remained unchanged as Powell addressed the Senate Banking Committee on Wednesday, underscoring the Fed’s commitment to a data-dependent approach.

This measured tone stood in sharp contrast to President Trump’s latest calls for immediate rate cuts to lower debt servicing costs. While some Fed officials, such as Michelle Bowman and Christopher Waller, suggest a rate cut could come as early as July, others are more hesitant. Cleveland Fed President Beth Hammack said rates may remain on hold “for quite some time” given elevated uncertainties. Meanwhile, Fed Chair Powell declined to commit to a July move, saying the committee is still waiting for clarity on upcoming inflation data.

However, the global backdrop remains volatile. Oil prices continue to swing amid fragile ceasefire conditions between Israel and Iran, a key geopolitical risk that could fuel commodity-driven inflation. Traders and policymakers are on edge, waiting to see whether upcoming data confirms a sustained downtrend in inflation or if renewed price pressures force a policy rethink.

One thing is clear – the U.S. dollar is weakening. The shift in sentiment has already fueled renewed strength in the Euro and Japanese yen as traders pivot toward currencies backed by more favorable macro trends. From a technical perspective, USDJPY and EURUSD are trading near key levels, with price action reflecting this evolving landscape.

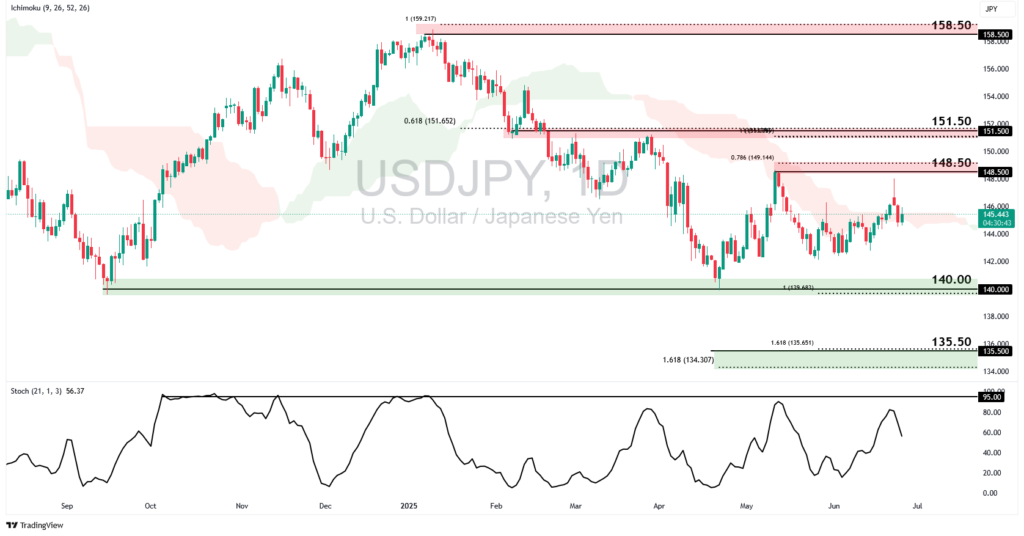

USDJPY Approaching Resistance

USDJPY has come under pressure as demand for the US dollar wanes, while the Japanese yen finds support amid expectations that the Bank of Japan will continue tightening policy. If this trend persists, USDJPY’s bearish momentum could continue building.

Ticker: USDJPY, Timeframe: Daily

USDJPY is approaching the 148.50 resistance, in line with the 78.6% Fibonacci Extension level and previous swing highs. The Stochastic Indicator indicates that prices are reaching overbought levels, suggesting that a potential reversal could be underway. The price could push lower towards the 140.00 swing low support, in line with the 100% Fibonacci Extension level. A break below the 140.00 support could prompt a further decline toward the 135.50 support, in line with a key Fibonacci confluence zone.

However, if USDJPY retraces further and closes above the 148.50 resistance, the price could retest the 151.50 resistance level, in line with the 61.8% Fibonacci Retracement and 100% Fibonacci Extension levels.

EURUSD Testing Key Highs

The Euro continues to benefit from broad U.S. dollar weakness, driven by uncertainty around Trump’s policies and geopolitical strife. As the U.S. dollar loses its shine, the Euro is gaining traction as a viable alternative, helping to fuel EURUSD’s bullish momentum.

Ticker: EURUSD, Timeframe: Daily

EURUSD is still seeing bullish momentum as the price holds above the 50-EMA and Ichimoku cloud. A decisive break and close above the 1.1720 resistance zone, in line with the 78.6% Fibonacci Extension level, could pave the way for an extended rally towards the next resistance at the 1.1880 resistance, in line with the 161.8% Fibonacci Retracement and 100% Fibonacci Extension levels.

However, a break below the support and 23.6% Fibonacci Retracement near 1.1450 could see the price move lower to retest the 1.1050 support, which aligns with the 61.8% Fibonacci Retracement level.

Inflation continues to be a key point of concern. A spike in oil prices or further escalation in trade tensions could reignite inflation fears and derail expectations for Fed rate cuts. With the Fed and traders keeping a close eye on upcoming inflation prints, markets are locked on one question: Will cooling data be enough to force the Fed’s hand?