Yen on the Clock: Japan’s Tug-of-War between Inflation and Growth

Japan is at a pivotal juncture. The Bank of Japan (BoJ) recently ended its decade-long ultra-loose monetary policy, nudging interest rates up to 0.5%, yet remains cautiously positioned. In contrast to most major economies moving toward rate cuts, Japan stands out as one of the few pursuing rate hikes. This reflects its long-standing battle against stagflation, a challenge that continues to shadow the BoJ’s policy stance.

Tokyo consumer price index (CPI) inflation held steady at 3.4% year-on-year in May, broadly in line with market expectations. Yet core inflation, excluding fresh food, accelerated to 3.6% from 3.4%, beating the market consensus of 3.5%. While this appears encouraging on the surface, much of the price pressure is still believed to come from cost-related factors such as higher goods and services prices, rather than a firm pickup in wage-led demand. What the BoJ is aiming for is sustainable wage-push inflation, where rising wages drive consumer demand and create a self-reinforcing cycle of price growth. Nevertheless, the BoJ’s path of further rate hikes looks optimistic going forward. BoJ Governor Kazuo Ueda told parliament earlier this week that the central bank is prepared to raise interest rates again, provided there is sufficient confidence that underlying inflation is sustainably approaching the 2% target.

One consequence of maintaining ultra-low interest rates over the past decade has been prolonged weakness in the Japanese yen. This has fueled the carry trade – borrowing yen cheaply to invest in higher-yielding currencies, thereby putting downward pressure on the Japanese yen. However, with the BoJ now signaling policy normalisation, this global carry trade dynamic may gradually unwind, supporting demand for the yen. The USDJPY pair has already slipped below the 145 handle, driven by weaker dollar demand, safe-haven flows amid global uncertainty, and shifting interest rate expectations. If these trends persist, the yen could see continued strength.

USDJPY Seeing Continued Downward Pressure

Persistent dollar weakness and relative yen strength have been the primary drivers behind USDJPY’s recent decline. As traders shift away from US assets, the downtrend may extend. While a lull in safe-haven demand could soften yen inflows, ongoing geopolitical concerns could sustain the safe-haven appeal for the Japanese yen.

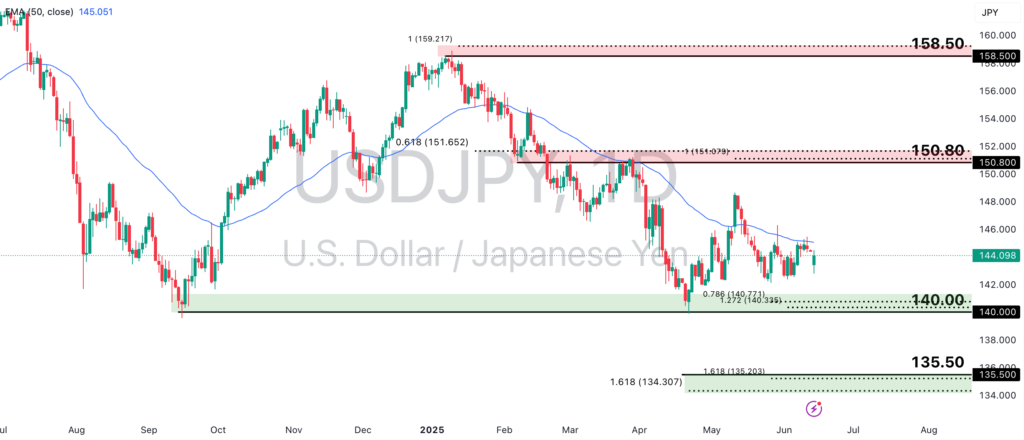

Ticker: USDJPY, Timeframe: Daily

USDJPY remains under pressure, trading below the 50-EMA. If the bearish momentum continues, price may drift lower toward the 140.00 swing low support, aligning with both the 78.6% Fibonacci retracement and 161.8% Fibonacci extension levels. A deeper decline could even push USDJPY toward the 135.50 support, which aligns with the 161.8% Fibonacci Retracement and Extension levels.

However, if price rebounds, a pullback toward the 150.80 resistance, marked by the 61.8% Fibonacci retracement and 100% Fibonacci extension could occur.

AUDJPY Eyeing A Sustained Bullish Breakout

In contrast, the Aussie has shown resilience as a commodity-linked currency, especially against a weakening US dollar. Technical indicators suggest a potential shift in momentum for AUDJPY, though the Japanese yen’s safe-haven appeal remains a wild card amid escalating geopolitical tensions.

AUDJPY has seen a breakout above the descending trendline resistance and is now hovering above the 50-EMA. A sustained break and close above the 95.50 resistance level, in line with the 38.2% Fibonacci Extension level, could prompt continued bullish momentum. The price could extend gains towards the 102.00 swing high resistance level, in line with the 100% Fibonacci Extension level.

However, a break below the 91.50 support level, in line with a Fibonacci confluence zone, could prompt a deeper retracement, potentially dragging prices toward the 87.00 swing low support, in line with the 100% and 161.8% Fibonacci Extension levels.

As global concerns surrounding the Middle East conflict evolve, it is important to keep an eye on any developments that could swing risk sentiment. At the same time, keep an eye on BoJ commentary for further clarity on its pace of rate hikes going forward.